How to apply taxes to an invoice in invoicing application?

To apply taxes to an invoice in Metro ERP's Invoicing App, follow these steps:

1) Go to the "Invoicing" module by clicking on its icon in the main dashboard or using the application menu.

2) You can either create a new invoice by clicking the "Create" button or access an existing invoice from the list view.

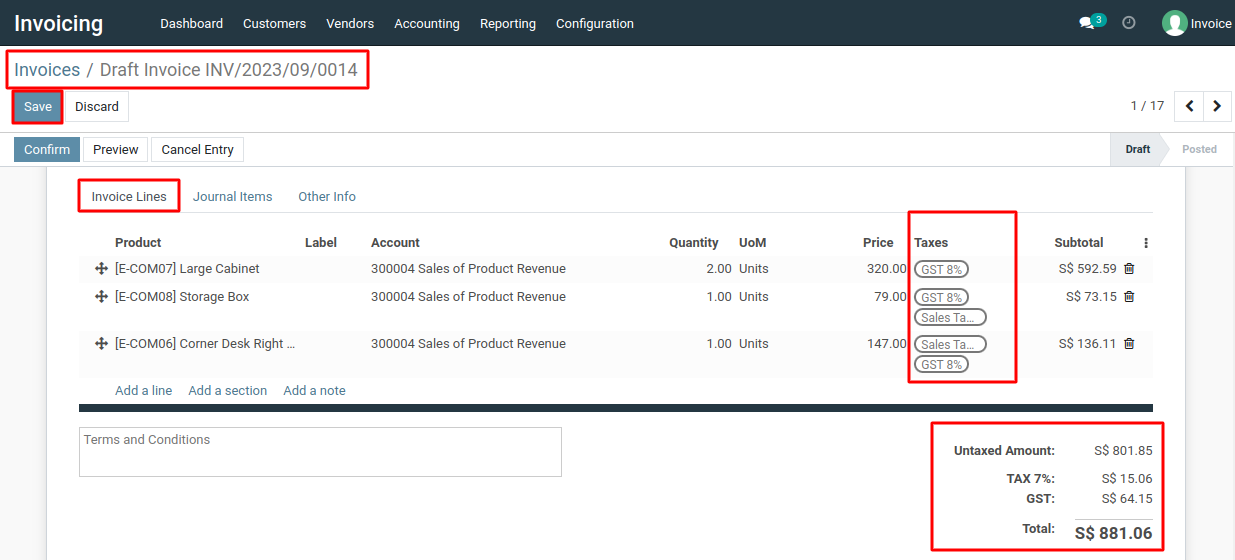

3) In the invoice form, scroll down to the "Invoice Lines" section.

4) Add the products or services to the invoice by clicking on the "Add a Line" button.

5) For each invoice line (product or service), enter the quantity, unit price, and any applicable taxes in the respective fields.

6) Under the "Taxes" column of each invoice line, click on the tax field to select the applicable tax from the dropdown menu. You can select multiple taxes if necessary.

7) The system will automatically calculate the tax amount based on the tax rates you've configured.

8) Once you've confirmed that the invoice is accurate, you can click the "Save" button to create and save the invoice with the applied taxes.

To apply taxes to an invoice, please do contact us at support@metrogroup.solutions